California Parent To Child Property Tax Exclusion Form . California revenue and taxation code section 63.1. The claim for reassessment exclusion for transfer between parent and child occurring on or after. both parents can combine their exclusions for a limit of $2 million dollars. claim for reassessment exclusion for transfer between parent and child note: effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and up to $1 million.

from vernitaxlaw.com

effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and up to $1 million. both parents can combine their exclusions for a limit of $2 million dollars. The claim for reassessment exclusion for transfer between parent and child occurring on or after. claim for reassessment exclusion for transfer between parent and child note: California revenue and taxation code section 63.1.

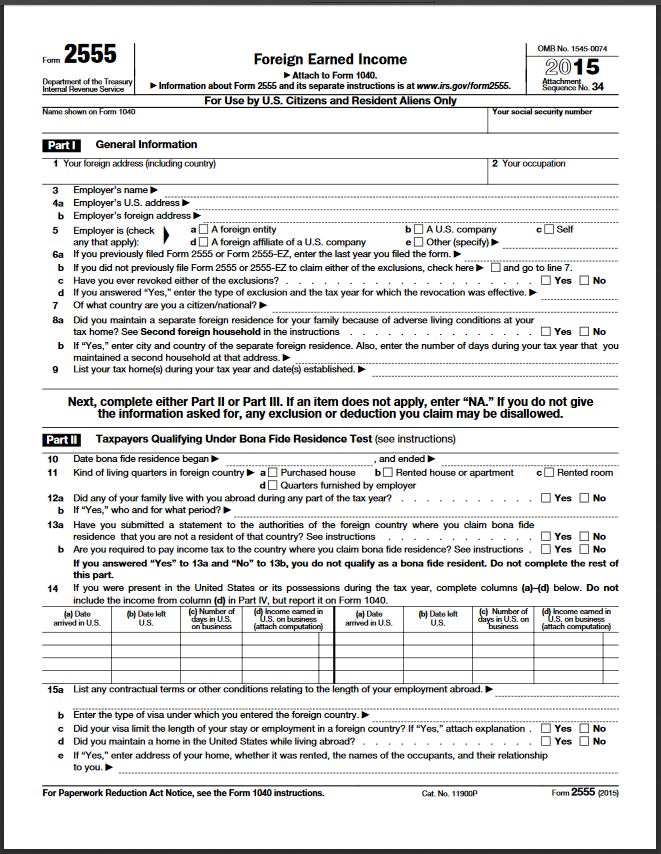

Foreign Earned Exclusion Form 2555 Verni Tax Law

California Parent To Child Property Tax Exclusion Form California revenue and taxation code section 63.1. The claim for reassessment exclusion for transfer between parent and child occurring on or after. both parents can combine their exclusions for a limit of $2 million dollars. claim for reassessment exclusion for transfer between parent and child note: effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and up to $1 million. California revenue and taxation code section 63.1.

From propertytaxnews.org

Prop 19 ParenttoChild Exclusion California Property Tax California Parent To Child Property Tax Exclusion Form both parents can combine their exclusions for a limit of $2 million dollars. California revenue and taxation code section 63.1. effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and up to $1 million. claim for reassessment exclusion for transfer between parent and child note: The claim for reassessment. California Parent To Child Property Tax Exclusion Form.

From www.templateroller.com

California Claim for Exclusion From Supplemental Assessment for New California Parent To Child Property Tax Exclusion Form claim for reassessment exclusion for transfer between parent and child note: The claim for reassessment exclusion for transfer between parent and child occurring on or after. both parents can combine their exclusions for a limit of $2 million dollars. effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and. California Parent To Child Property Tax Exclusion Form.

From propertytaxnews.org

Prop 58 and an Irrevocable Trust Loan California Property Tax California Parent To Child Property Tax Exclusion Form The claim for reassessment exclusion for transfer between parent and child occurring on or after. both parents can combine their exclusions for a limit of $2 million dollars. claim for reassessment exclusion for transfer between parent and child note: California revenue and taxation code section 63.1. effective november 6, 1986, transfers between parents and their children (in. California Parent To Child Property Tax Exclusion Form.

From propertytaxnews.org

CA Prop 58 Parent to Child Exclusion From Current Market Reassessment California Parent To Child Property Tax Exclusion Form The claim for reassessment exclusion for transfer between parent and child occurring on or after. both parents can combine their exclusions for a limit of $2 million dollars. effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and up to $1 million. claim for reassessment exclusion for transfer between. California Parent To Child Property Tax Exclusion Form.

From propertytaxnews.org

Proposition 58 Property Tax Breaks in 2021 Archives California California Parent To Child Property Tax Exclusion Form The claim for reassessment exclusion for transfer between parent and child occurring on or after. both parents can combine their exclusions for a limit of $2 million dollars. effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and up to $1 million. California revenue and taxation code section 63.1. . California Parent To Child Property Tax Exclusion Form.

From cloanc.com

Parent to Child Exclusion Archives Commercial Loan Corp, Provider of California Parent To Child Property Tax Exclusion Form California revenue and taxation code section 63.1. effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and up to $1 million. The claim for reassessment exclusion for transfer between parent and child occurring on or after. claim for reassessment exclusion for transfer between parent and child note: both parents. California Parent To Child Property Tax Exclusion Form.

From www.formsbank.com

Fillable Boe58Ah Claim For Reassessment Exclusion For Transfer California Parent To Child Property Tax Exclusion Form California revenue and taxation code section 63.1. claim for reassessment exclusion for transfer between parent and child note: both parents can combine their exclusions for a limit of $2 million dollars. effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and up to $1 million. The claim for reassessment. California Parent To Child Property Tax Exclusion Form.

From www.templateroller.com

Form AV10 Download Fillable PDF or Fill Online Application for California Parent To Child Property Tax Exclusion Form claim for reassessment exclusion for transfer between parent and child note: The claim for reassessment exclusion for transfer between parent and child occurring on or after. California revenue and taxation code section 63.1. both parents can combine their exclusions for a limit of $2 million dollars. effective november 6, 1986, transfers between parents and their children (in. California Parent To Child Property Tax Exclusion Form.

From www.sampletemplates.com

FREE 10+ Sample Tax Exemption Forms in PDF California Parent To Child Property Tax Exclusion Form The claim for reassessment exclusion for transfer between parent and child occurring on or after. effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and up to $1 million. California revenue and taxation code section 63.1. both parents can combine their exclusions for a limit of $2 million dollars. . California Parent To Child Property Tax Exclusion Form.

From cloanc.com

Parent to Child Transfer Archives Commercial Loan Corp, Provider of California Parent To Child Property Tax Exclusion Form California revenue and taxation code section 63.1. both parents can combine their exclusions for a limit of $2 million dollars. effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and up to $1 million. claim for reassessment exclusion for transfer between parent and child note: The claim for reassessment. California Parent To Child Property Tax Exclusion Form.

From vernitaxlaw.com

Foreign Earned Exclusion Form 2555 Verni Tax Law California Parent To Child Property Tax Exclusion Form effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and up to $1 million. both parents can combine their exclusions for a limit of $2 million dollars. The claim for reassessment exclusion for transfer between parent and child occurring on or after. claim for reassessment exclusion for transfer between. California Parent To Child Property Tax Exclusion Form.

From www.exemptform.com

Fillable Form R 1310 Certificate Of Sales Tax Exemption Exclusion For California Parent To Child Property Tax Exclusion Form effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and up to $1 million. both parents can combine their exclusions for a limit of $2 million dollars. California revenue and taxation code section 63.1. The claim for reassessment exclusion for transfer between parent and child occurring on or after. . California Parent To Child Property Tax Exclusion Form.

From propertytaxnews.org

Prop 58 and its' ParentChild Exclusion California Property Tax California Parent To Child Property Tax Exclusion Form California revenue and taxation code section 63.1. effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and up to $1 million. claim for reassessment exclusion for transfer between parent and child note: both parents can combine their exclusions for a limit of $2 million dollars. The claim for reassessment. California Parent To Child Property Tax Exclusion Form.

From danabal-akshayaassociates.blogspot.com

annual federal gift tax exclusion 2022 Avelina Keel California Parent To Child Property Tax Exclusion Form both parents can combine their exclusions for a limit of $2 million dollars. effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and up to $1 million. The claim for reassessment exclusion for transfer between parent and child occurring on or after. California revenue and taxation code section 63.1. . California Parent To Child Property Tax Exclusion Form.

From www.templateroller.com

Download Instructions for Form BOE58AH Claim for Reassessment California Parent To Child Property Tax Exclusion Form effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and up to $1 million. The claim for reassessment exclusion for transfer between parent and child occurring on or after. claim for reassessment exclusion for transfer between parent and child note: California revenue and taxation code section 63.1. both parents. California Parent To Child Property Tax Exclusion Form.

From cloanc.com

California Proposition 58 Parent to Child Property Tax Transfer California Parent To Child Property Tax Exclusion Form effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and up to $1 million. claim for reassessment exclusion for transfer between parent and child note: both parents can combine their exclusions for a limit of $2 million dollars. California revenue and taxation code section 63.1. The claim for reassessment. California Parent To Child Property Tax Exclusion Form.

From www.jmrlanduse.com

Proposition 19 Parent To Child Exclusion JMR California Parent To Child Property Tax Exclusion Form claim for reassessment exclusion for transfer between parent and child note: California revenue and taxation code section 63.1. The claim for reassessment exclusion for transfer between parent and child occurring on or after. effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and up to $1 million. both parents. California Parent To Child Property Tax Exclusion Form.

From blanker.org

OCFS6022. Request for Staff Exclusion List Check Forms Docs 2023 California Parent To Child Property Tax Exclusion Form both parents can combine their exclusions for a limit of $2 million dollars. The claim for reassessment exclusion for transfer between parent and child occurring on or after. claim for reassessment exclusion for transfer between parent and child note: effective november 6, 1986, transfers between parents and their children (in either direction) of a principle residence and. California Parent To Child Property Tax Exclusion Form.